What is a Checking Account?

A checking account is a spending account that gets its name from the act of writing a check to transfer money. It’s the most common type of bank account and is distinct from other account types, such as money market or certificate accounts, in that there are practically no restrictions on how often you may access your funds. While writing a check is just one method of transferring money from which this account was named, there are now many other options to transfer money, such as using online or mobile banking or a debit card.

Learn more about SDCCU checking accounts.

What is a Check and How Do They Work?

A check is a written financial document that enables the account holder to transfer money to another party by specifying the recipient, amount and date. SDCCU ensures a seamless experience where check recipients can conveniently deposit funds at any of our branch locations or use the SDCCU Mobile Deposit feature within our mobile banking app. Additionally, we offer convenient ways to order checks: through Internet Branch online banking, allowing secure online tracking, or by phone from Harland-Clarke at (800) 355-8123, where orders can be placed by providing specific account details. Understanding the purpose and functionality of checks is crucial in today's digital age, where electronic transactions prevail, and SDCCU remains committed to providing solutions that align with the evolving financial landscape.

Routing, Account and Check Numbers: What’s the Difference?

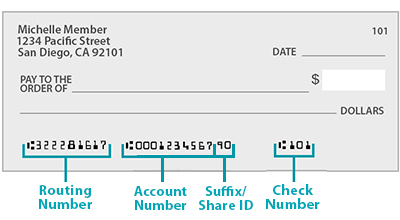

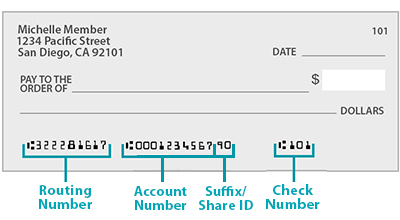

A Routing Number (or ABA Routing Number) serves as a financial institution’s identification number and can be found on the lower left side of your checks, as seen below. SDCCU’s ABA Routing Number is 322281617.

Similarly, your checking account number uniquely identifies your checking account. Your checking account number is the lower middle number on your checks, shown below.

The check number is seen at the bottom right and the upper right corner of your checks.

How Do You Cash a Check?

At SDCCU, you have multiple options for cashing checks. Start by endorsing the back of the check with your signature and log into our user-friendly SDCCU mobile banking app to deposit the check by capturing the check image using the SDCCU Mobile Deposit feature within the app. You can visit any of our Orange, Riverside or San Diego county branch locations, where our friendly tellers are ready to assist you. Simply present the endorsed check, along with a valid photo ID to the teller for a hassle-free transaction. You can also utilize one of our deposit taking surcharge-free ATMs, located throughout Southern California, including San Diego County, Riverside County and Orange County.

Choosing a Checking Account

SDCCU offers a few options for checking accounts, depending on your needs. To understand the complete range of services that may incur fees, it’s recommended that you read our Consumer Services Fee Schedule.

- FREE Checking with eStatements – As indicated in the name, this account incurs no monthly service fees when you sign up to receive eStatements. An eStatement is an electronic version of your statement, which can be viewed securely through Internet Branch online and mobile banking1 at sdccu.com. There is no minimum balance requirement, other than an opening deposit of $25.

- Classic Checking – A Classic checking account is ideal for those wanting to earn monthly dividends on their balance. Dividends are similar to interest paid by banks. Dividends may be paid monthly with an average daily balance of $1,500 or more. See our current checking account rates to view Classic checking dividend rates. The monthly fee of $5 is waived with direct deposit ($100 minimum per pay period), $2,500 or more combined average daily savings balance or $1,000 or more average daily checking balance. The minimum opening deposit is $25.

- High-Yield Checking – A High-yield checking account is ideal for those wanting to earn higher returns on their balance. This personal checking account earns competitive dividends based on the average daily balance. Check out our current checking account rates to view High-yield checking dividend rates. Added benefits include higher potential dividends than classic checking and a FREE first box of corporate image checks. The monthly fee of $15 is waived with an average daily balance of $25,000 or more. The minimum opening deposit is $5,000.

- teenFIRST®Checking – The teenFIRST account is for members 13 to 17 years of age with a valid ID. While the teen will be the primary member on the account, their parent or guardian must be a Joint Owner on the account until the teen turns 18. Once they turn 18, the teenFIRST checking account automatically converts to a FREE Checking with eStatements account and is free when enrolled in eStatements. Otherwise, a monthly fee of $2 applies.

Benefits of a Checking Account

A checking account provides a secure and convenient way to manage your finances with a high level of liquidity. With features like easy access to funds through debit cards and online banking, checking accounts enable swift and efficient transactions. Additionally, services such as direct deposit and overdraft protection contribute to the flexibility and accessibility that make checking accounts a valuable tool for everyday financial management, ensuring that your money is readily available whenever needed.

Best Practices for Using a Checking Account

Internet Branch Online Banking

Accessing your checking account online is safe, secure and easy with SDCCU’s Internet Branch online banking. Register today and gain access to several convenient features, such as:

- Review an account summary

- Review transaction history in real time

- Transfer funds between your SDCCU accounts

- Review and print copies of paid checks

- Place stop payments on checks

- Update your personal information; address, phone number and email

- Order personal checks

- Open new accounts and apply for loans

- Review and download monthly eStatements

- Pay bills online with Bill Payer Plus® online bill pay

- Download your account history data to Quicken® or QuickBooks™

Keep a Cushion if You Can

SDCCU offers a variety of overdraft protection options, but it’s always best to keep a cushion in your checking account. Some purchases may take a while to post to your account, so keeping a cushion can help you avoid overdrawing your account if you lose track of exactly what was spent.

Track Your Spending

It’s best to set up account alerts to send you automated, real-time email or text messages when your account drops below a certain amount. If you write checks, make sure to keep records in your checkbook each time you write a check, deduct it from your balance and monitor your account to see when it clears.

Protect Your Data

At SDCCU, safeguarding your account is an important part of our business. Stay informed on best practices for protecting your personal and financial data on our Financial Knowledge page.

How to Check your Account Balance

Your checking account balance can be viewed by using an ATM, logging into Internet Branch online or mobile banking, visiting a branch or by calling us at (877) 732-2848 and using the Touch Tone Teller feature. Download our free mobile app and check your balance from your smartphone today.

How to Set up Direct Deposit

Whether your direct deposit is coming from your employer or from another entity, changing the account your payments are deposited to is an easy process. Simply fill out our Direct Deposit Form and return it to your payroll department.

Early Paycheck

When you have your paycheck direct deposited into your SDCCU checking account, you may have access to your funds a day earlier than your regularly scheduled payday2.

How Do I Get Started?

You can open a checking account online, via phone by calling (877) 732-2848 or by visiting any of our more than 40 branch locations. You will need to provide a form of government issued identification. If your form of identification is current and readily available, opening an account is quick and easy.

Get Started

Existing customers, log into Internet Branch online banking.